Do you need a good credit score for an apple card?.

Apple card credit score range how to#

How to Improve Your Credit Score (Recommended by Apple).How to Check Your Credit Score and Report.How is the Apple Card Application Evaluated?.Best Tips on Credit Scores Needed for Apple Card.Why Should You Apply for the Apple Card?.So, what credit score do you need to qualify for Apple Card? Let's find out! This average FICO score may result from shrinking debt, less to no late payments, and a decline in total debt/total credit ratio. And while there are many models for calculating a credit score, the FICO score is by far the most preferred by financial institutions.Īccording to Experian, the average FICO credit score (scores issued by any credit bureau including, Experian, Equifax, and TransUnion) in the US is 714 as of 2021. It measures an individual’s creditworthiness, and the higher the score, the less risky a borrower looks to potential lenders.Ī credit score is based on five credit factors including, payment history, amounts owed, length of credit history, account inquiries, and credit mix.

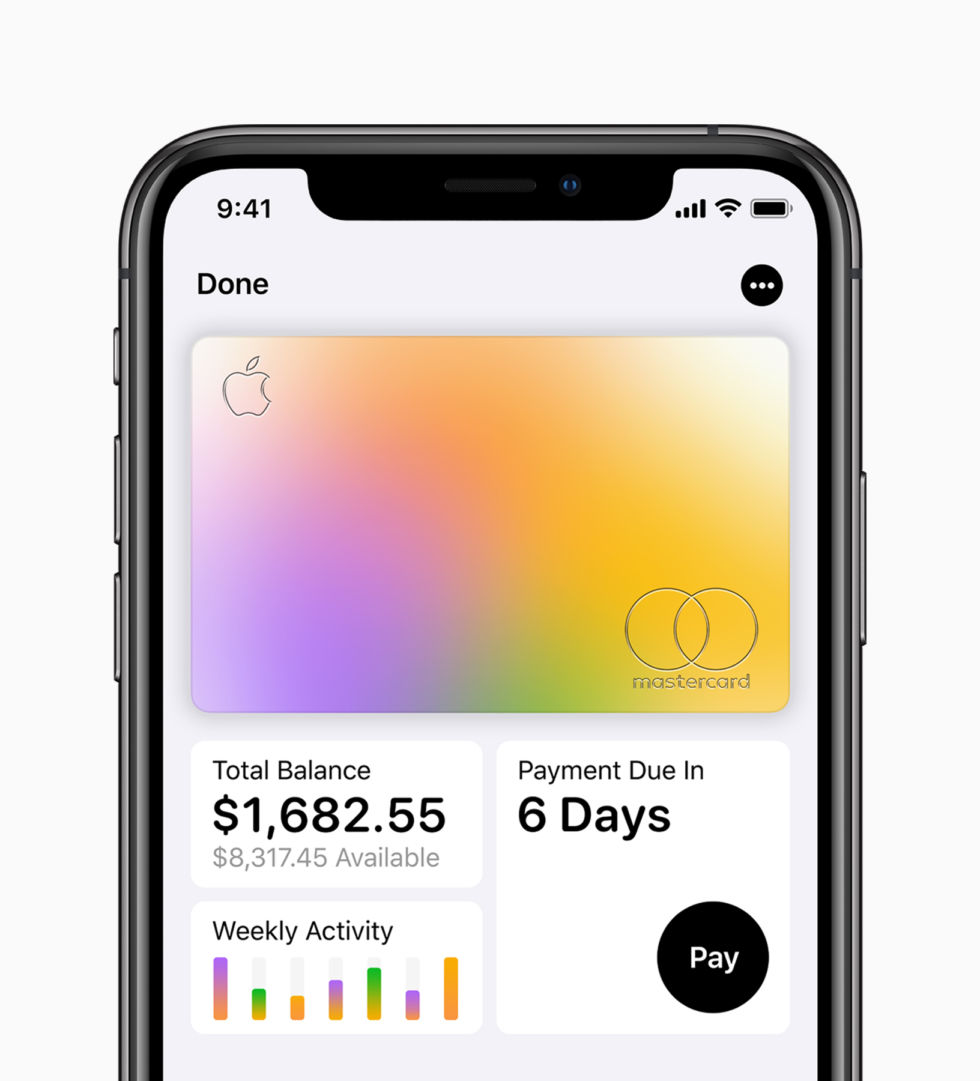

A credit score is a 3-digit number that falls between 300-850, 850 being the highest. Just like other companies, Apple requires credit scores to be accepted for the Apple Card program. It helps users pay off their balances, save money on fees and interest, and build credit gradually. What is the credit score needed for Apple Card? If you are looking to apply for the Apple Credit Card, here is what you need to make your approval more probable.Īpple and Goldman Sachs launched the Apple Card – a rewards credit card prioritizing security, privacy, and financial management.

0 kommentar(er)

0 kommentar(er)